It’s time for another step on our Twelve Months To Financial Fitness Challenge. In prior months we covered analyzing spending, creating a budget, preparing for taxes. This month, we look at creating a will. It’s not always an easy thing to think about, but preparing for your end of life will ultimately ensure your property is distributed as you wish, and to the benefit of those you care about most. In this article, we discuss why a will is important and how to create one. It’s not as scary as you think! While creating a will may not help your personal financial fitness, it can help your beneficiaries.

If you have missed any of our prior articles, you can go back and read them anytime. So far we have covered:

Why You Need A Will

Without a will, your state will decide who gets your property after your death. A legally binding will can prevent family disputes, as well as ensure your final wishes are honored. You can also provide for funeral expenses and appoint a particular person to be the executor of your will. An executor of your will should be someone you trust that is likely to survive you. Generally, people choose immediate family members or close friends. Others chose to appoint a neutral third party in order to eliminate potential conflicts between family members. Ultimately, your will protects your assets, allows you to control the distribution of property, and can forgive past debts owed to you. However, in order to reap the benefits of having a will, it must be properly formed and legally binding. We discuss more on making your will below.

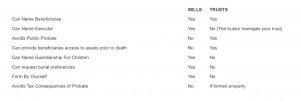

Difference Between A Will And A Trust

Most people are familiar with wills, and may even have heard of trusts, but may not know what the key differences are between the two. Both are tools to manage your estate and final affairs, and can even work in conjunction with each other. The biggest difference between a will and trust is when they become effective. A trust is effective immediately after it is properly formed, while a will does not take effect until your death. Below we compare key differences and similarities between both.

How To Create A Will

Hire A Professional

It goes without saying that hiring a professional is the most secure way to form your will or trust. Attorneys and accountants are best equipped to help you decide how to manage your estate, either through a trust, will, or both, as well as prepare the necessary documents. The more complicated your estate, either through diverse investments and property, or have a number of beneficiaries, the more you should rely on a professional to ensure any documents are properly and legally formed. Otherwise, you risk hitting your beneficiaries with tax penalties or invalidating the will altogether. When in doubt, consult the experts.

Online Legal Services

There are also legal services available online that use attorneys or paralegals to assist you in forming your will at a much lower cost. If you want the security of a professional, but without the price tag, a quick online search will lead you to licensed will preparation help. Most offer guarantees for your beneficiaries if there is a problem with the will after your death. However, while these companies use licensed attorneys and paralegals, there may be drawbacks to how specific you are able to get with your estate.

DIY Will

If your estate is fairly straightforward and costs are an issue, you may consider preparing your will on your own. Templates can be found at most libraries, office supply stores, and online. After you prepare the document, you will need to execute the will according to the laws of your state, typically by signing in front of a witness and having the document notarized.

Tip: to save costs on professional services, if you prepare the will yourself, you can always hire an attorney or accountant to review. This review will be less expensive because you did most of the preparation beforehand, and you still get the peace of mind of knowing everything is in proper order.

The Challenge

Set a goal to start preparing your will (or trust). Identify your assets, beneficiaries, and any special needs you may have. Then get started either by contacting a professional or doing it yourself. Even if you don’t finish your will completely this month, you’ll be well on your way.

Retirement planning help

Confused about what all you need to prepare a will and plan for your retirement? We’re happy to guide you. Contact us today.

Brought to you by our friends at BALANCE