You’ve worked hard for your savings and shouldn’t have to worry about anyone getting in the way of it. Scammers often use tactics such as check and SMS scamming to get ahold of your information. We’ve got the scoop on how to steer clear of common financial scams.

Don’t be Fooled by a Remote Deposit Capture/Check Scam

Scammers are always looking for ways to prey upon people, especially those consumers needing money quickly. One way they do this is by using Remote Deposit Capture (RDC), a service which allows you to deposit a check remotely into your account.

The basic ploy these scammer use is to tell you they will deposit money into your account if you agree to send part of the money back to them. To complete this transaction, you must give them your credit union account details. The scammer then deposits a check into your account using RDC. Since credit unions and banks are required by law to make funds from deposited checks available within 1-2 days, you see the money in your account right away. You then wire part of money back to scammer and keep the rest. Sounds like easy money, doesn’t it? Not so fast…

When the financial institution attempts to collect the funds from the scammer’s bank, they discover the check is fake. That leaves you responsible for the amount on the check and the returned check fee. And that money you already wired to the scammer? You will never get that back.

Other variations of the RDC/Check scam include:

An online loan website

To receive the loan, you must give the company your credit union account number, online username, and password so the company can deposit the check into your account. The company deposits a check using remote deposit capture and then instructs you to return the money to prove you are trustworthy.

Mystery shopping

The scammer hires you to evaluate stores. The “employer” deposits a check into your account and instructs you to use some of the money to buy gift cards from these stores. You must send the “employer” the PIN numbers for the gift cards you purchased.

Personal Assistant jobs

You apply online and are required to give your new boss your account information. The boss deposits a check into your account and, like the scenario above, tells you to use part of it to buy gift cards. You just need to give the boss the PIN numbers.

Car-wrap advertising job

You are offered thousands of dollars to wrap your car with a company’s ad. The check is deposited into your account and you are told to wire part of amount to their shrink-wrap vendor. (The scammer and vendor are really the same person). After you wire the money, the credit union finds out the check was fake, and your “employer” has disappeared.

Bottom line: Never give your online banking information to anyone you don’t know or trust.

Spot the Spam: Text Message Scammers

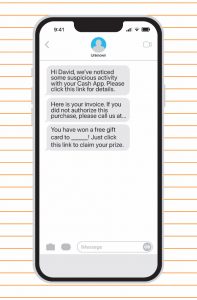

Have you gotten text messages from an unknown sender like this?

Scammers use messages like these to get your credit card number or other personal information. This may include a link to a spoofed website that looks real, but will steal your username and password. Other messages might install malware on your phone.

Warning: If you get messages like these, don’t like any links. If you’re unsure if it is legitimate, call the company using a phone number you know is real, not the one in the message, to verify it.